Futura-Mobility visits the Port of Marseille

Futura-Mobility visits the Port of Marseille

At the end of November 2021, members of Futura-Mobility took advantage of the 3rd edition of Smart Port Day to visit Marseille and discover the innovation ecosystem of this French port city. Members, working in innovation and development at the companies Alstom, SNCF, Keolis and Air Liquide made the trip alongside the Futura-Mobility team.

A visit to the Grand Port Maritime de Marseille (GPMM), especially its West harbours in the Gulf of Fos, and many meetings over the two days gave the group plenty of insight into the close links between the maritime sector and globalisation, as well as opportunities to discover the wealth of resources within the port and logistics ecosystem, the vital link with the hinterland and related issues (modal shift), as well as sector-specific, environmental and digital challenges.

All in the same boat

During these meetings, the members were particularly struck by the close bonds between stakeholders to promote the attractiveness of the port community at Marseille Fos. As Hervé Martel, president of the GPMM board of directors, puts it, there are indeed a multitude of interdependent professions. “What really counts for clients is the quality of the overall service – so you could say we’re all in the same boat.”

The competitors have joined forces in trade unions (freight forwarders, harbour pilots, docking pilots, underwriters, shipping agents, handling operators, shipowners…) and through an inter-professional trade organisation, the Union Maritime et Fluviale de Marseille Fos (UMF). The competitors regularly do favours for each other, like, for instance, making it possible to sell part of the capacity of a vessel belonging to one shipowner to another, in order to maximise the load ratio.

Developed by MGI, a company owned by the GPMM and UMF, the ‘CI5’ joint information system enables tracking of goods across all the different stages (harbour master, customs, veterinary service, etc). “A good example of a public-private partnership success story!” welcomes Léa Loriquet-Ventura, delegate general, UMF. Indeed, it’s living proof of the high level of cooperation within the UMF. “All the documents are scanned,” explains Stéphane Boumendil, project manager at the UMF, “which helps save tons of time! For instance, over recent years customs clearance has gone from 24hrs to a few minutes.” When one knows how, in the field of public transport, discussions sometimes turn bitter between stakeholders over providing their data for MaaS systems!

Thanks to this transversal CI5 tool, the port stakeholders have been able to go further and adopt common performance indicators. These ‘Key Performance Indicators’ improve dialogue between all parties to boost service quality and allow each and every one to advance with a shared objective in mind: boosting the reliability of Marseille’s port community.

Another example of cooperation are plans for 2040 to develop the industrial-port zone at Fos. According to Hervé Martel, GPMM president, “we can’t organise this by planning to extend the land grab because we have to avoid artificialising the area. The port must be built on the port.” All the stakeholders concerned are being consulted in this participatory approach.

From oil to data – from old gold to new?

The port of Marseille Fos boomed in the 70s, revolving primarily around oil and petrochemical activities at Fos-Sur-Mer. “Crude was the beating heart of our profitability,” explains Alexandre Antonakas, head of diversification projects, digital IT & equity participation. Today, refining operations are now being carried out in oil producing countries. “There are still three refineries at Fos, but looking ahead to 2050, they probably won’t be here anymore,” anticipates Mr Martel.

In 1980-90, “the port of Marseille Fos unfortunately missed out on the containerisation of goods,” states Hervé Martel, president, GPMM. Indeed, Marseille doesn’t figure among the world’s top 100 biggest container ports – unlike those of Piraeus in Greece, Gioia Tauro and Genoa in Italy, Barcelona, Valence and Algésiras in Spain, or Ambarli and Izmit in Turkey – its closest neighbours on the north coast of the Mediterranean. Nevertheless, container goods traffic transiting through the Port of Marseille grew from 900,000 to 1.5 million TEU (20-foot equivalent units) between 2010 and 2019. For Mr Martel: “with the surge in e-commerce the market is developing at lightning speed. Overall, we must to be able to propose competitive solutions that are incorporated into the hinterland and even extend up to the last mile.”

The port in 2040? Hervé Martel is convinced “it will be radically different!” A total of 41,500 jobs, direct and indirect, are at stake, with skills that need to be developed.

Stakeholders at the Port of Marseille are especially counting on their expertise in energy. Many energy projects are emerging, ranging from wind turbines on floaters out at sea to installing solar panels on ‘abandoned’ plots of land (i.e., where it is difficult to use the space otherwise), and including electrifying the docks for ferries and cruise ships, or creating a green hydrogen sector notably for “decarbonising the industry located at the port and on the Rhône route,” explains Mr Martel. Regarding development of wind turbines, “we are hoping to grow the business [within the GPMM] of building floaters and possible even the turbines and blades,” anticipates Michaël Parra, energy transition lead at the GPMM, who welcomed the group at the Fos-sur-Mer harbours.

Moreover, several energy-related projects won awards at Smart Port Day #3: one in particular, by the company Farwind, which caught the attention of EDF, is for an energy storage ship that, as founder Félix Gorintin puts it, seeks out “fair winds” far-offshore and brings this energy back to port; two projects based on methanation of waste, either collected directly at the port with BioBeeBox – a project selected by VEOLIA, or at regional level with the project by Synchronicity, picked out by CMA-CGM.

The GPMM is also developing its ‘real estate’ business activities. Indeed, the total surface area within the port covers 400 hectares at the East harbours and 10,000 hectares at the West. This vast port domain has long been underdeveloped. “We’re not at the market prices,” confirms Mr Martel. The teams, recently boosted by the arrival of an expert on the subject, are keen to make better use of this terrain, with a comprehensive view of its development over the long term and taking on board the many issues that coexist – notably encouraging modal shift to the waterways and rail, or preserving the environment. The West harbours are indeed home to 3,000 hectares of natural habitats which the Port has freely chosen to protect! And they lie at the convergence of the Camargue natural regional park, Coussouls de Crau nature reserve, and the mouth of the river Rhône. During their visit, members of Futura-Mobility spotted pink flamingos and the wild white horses of the Camargue. So, the strategy involves working on a pricing policy for the real estate, together with new services, which will save time when introducing new activities. “The port can propose biodiversity measures, for instance, in a sequence 1. avoid 2. reduce, and 3. compensate, because we know the land well,” explains Mr Martel.

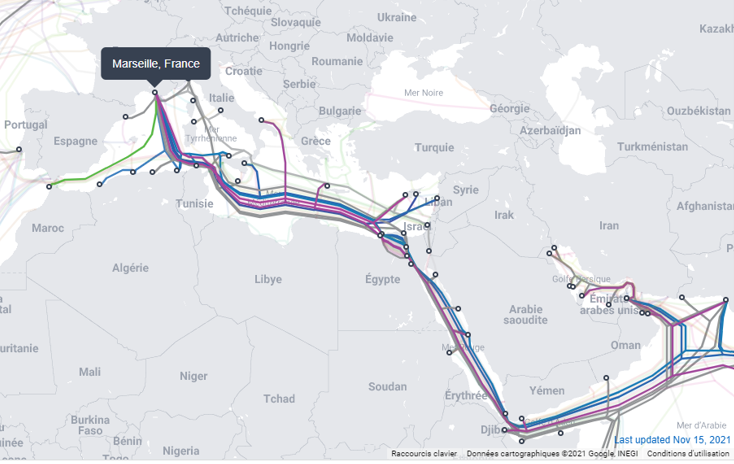

The third focus of the Port’s diversification strategy depends on digital; the aim being to make Marseille the 5th global hub for data exchange. InterXion, a leading player in the field of data centres, is locating massively to Marseille. The position of the port city being a key strength. “Marseille is becoming ‘the place to be’ for data centres,” points out Mr Antonakas. The submarine cabling is connected to the shore via the port. The high level of security within the port area, due to the International Ship and Port Facility (ISPS) Code – a mandatory security regime for international shipping – is a considerable advantage for operators. This may be a new line of business for the port, but it still involves developing and managing sensitive infrastructure.

Another string to the Port’s conversion bow is its role as investor. The GPMM is keen to “move up the value chain, in other words, to increase its stakes in projects,” explains Mr Martel, GPMM president. The two main focus areas for investing, as indicated by the latter, are logistics and digital. Hence reflection is ongoing over the right legal structuring, the appropriate governance for this ‘business angel’ activity, sizing funding, and identifying the right public or private partners. On this point, “functioning as an ecosystem is key to success,” considers Mr Antonakas.

The port and maritime ecosystem – spearheading decarbonisation

Meeting the many different stakeholders over this two-day visit revealed how decarbonisation is well on track. “It’s making rapid progress, faster than we could have imagined!” exclaims the president of the Port.

“In the future, there needs to be a partnership between the GPMM, SNCF and VNF [French waterways authority] for flow consolidation by rail,” points out Claude Flor, professor emeritus, CRET LOG, Aix-Marseille University, thus broaching the subject of shifting traffic off the roads and onto rail or the river Rhône to curb the carbon impact of land freight transport.

Today, in Marseille, just 15% of the flow of goods travels by rail, 5% by river. With the infrastructure that already exists for the inland waterways, “it would already be possible to boost the volumes transported by barge three or four times!” points out Stéphane Boumendil from the UMF, based on analysis by VNF. “The long-term objective is to reach 30% by rail,” adds Léa Loriquet-Ventura, delegate general of the UMF. On this particular topic, several work streams were evoked during Futura-Mobility’s visit: building a rail hub at the West harbour in Fos, introducing ‘block trains’ or longer trains to transport goods from one port to a destination city, contracting with companies located along the Rhône to shift goods by barge to and from Marseille. For Ms Loriquet-Ventura, “the journey times are obviously a key issue, but at the end of the day it’s all relative when you think about the service quality, decarbonisation, and prices enabled by these solutions.”

The Port of Marseille is particularly constrained when it comes to environmental matters which, at times, collide. For instance, a project to cut a canal from the Rhône across a piece of land at Fos for easier transhipment by barge, and modal shift as a consequence, has been halted because of the need to protect the biodiversity along the planned route. Since an alternative route would prove too costly and lose the time savings considered necessary, the project has been aborted.

Not to be outdone by this move towards decarbonisation, for the roads electrification of vehicles and the use of biomethanol is under development. Enough to encourage the other transport modes, rail and river, to continue greening themselves, so as not to lose the upper hand. Nevertheless, these latter modes will always meet a need for flow consolidation to free up the roads, and so address the issue of the liveability of the territory for inhabitants and workers. As Mr Boumendil explains, “the competitive strength of consolidated modes will always exist, the environmental impact of barges and trains will in any case be less than trucks, precisely because of consolidation.”

One of the global leaders in maritime transport and logistics, the Marseille-based CMA-CGM Group, whose vice-president for sustainable development, Claire Martin, the members of Futura-Mobility met during their visit, has opted for NLG propulsion for its ships since it immediately enables a reduction in emissions of air pollutants. The ultimate target being biomethane, then synthetic methanes, of which e-methane. The molecule is of interest because “our ships that today are using GNL are already capable of using these less carbonated energy sources.” Hence the reason CMA-CGM selected the project for a biogas plant by Synchronicity, mentioned earlier in this article. According to Farid Trad, vice-president for energy, CMA-CGM, “decarbonising can start in the territory, by seeking out inputs with ties to the port, especialy along the outskirts of the Rhône.”

By adopting this approach, the CMA-CGM Group aims to become net zero carbon between now and 2050, a commitment announced during COP26.

Regarding hydrogen or wind propulsion, the French company is exploring these options too. “The challenge with hydrogen, for a company like CMA-CGM that sells space for goods, is stocking the large volume of hydrogen needed to propel a ship,” explains Ms Martin. As for wind propulsion with sails, for instance, “it looks promising”. It enables energy savings of up to 30% but depends on a technique adapted to regular sea routes subject to wind conditions.

Start-ups, which are also making a significant contribution to this innovative ecosystem, very often orient their activities to respect the planet’s resources. “Searoutes is a solution designed to meet a real need – namely that of making the C02 emissions of freight transport visible to shippers,” affirme Eva Cadilhac, marketing director and, furthermore, the start-up’s very first employee. Today the greenhouse gases (GHG) generated by transport represent up to 10% of shippers’ total GHG. Searoutes has exclusive technology that can process and transform vast databases with information about sea freight (positioning of ships, engine types and their characteristics, details on timetables, the weather…) into actionable information. So the start-up is helping shippers go beyond merely reporting the carbon footprint by pinpointing the levers for reducing GHG emissions across their logistics chain, for the maritime sector for the time being. For instance, a consignor cut its transport-related GHG emissions by 30% when making purchasing decisions that support fleets of ships that are more recent, bigger, and slower.

In the long term, the start-up aims to enable its clients to find the greenest routes from door to door, so by integrating logistics flow options by land, via rail and inland waterways. Reducing GHG from transport could, in this case, reach up to 60%. Moreover, on this very subject, Searoutes is starting a project in the Mediterranean with Medlink. “Giving visibility to green shippers and allowing consignors to take tangible action, this is the Searoutes vision,” explains Ms Cadilhac.

Decarbonising maritime transport maritime won’t happen overnight. Regulatory constraints are at times put into action to speed things up, but, in the light of the pandemic, the last one to date led to unexpected outcomes. In January 2020, the International Maritime Organisation (IMO) introduced a new 0.5% limit compared to the previous 3.5% for the maximum sulphur content in the fuel oil used on board ships. In a first step, companies have installed scrubbers “the cost of which was between three to five million euros per ship, in part funded by Saudi Arabia since it was keen for these companies to carry on using its heavy fuel oil… while Algerian oil, itself, contains far less sulphur,” explains Stéphane Salvetat, president of the Forwarders’ Syndicate of Marseille-Fos (STM), whom Futura-Mobility asked to explain the ongoing logistics crisis. These filters mean exhaust fumes can be cleaned without changing the fuel used or the engines. When demand for international freight transport plummeted in the early days of the Covid-19 crisis when factories in China and Chinese ports shut down, these unadapted ships were scrapped, “in other words, 15 to 20% of the global fleet,” reckons Stéphane Salvetat. As a result, since demand has shot up since economic recovery at the end of 2020, there is now a real shortage of ships and consequently loading capacity is sorely lacking in the maritime transport sector. “Freight rates have multipled by 5 even by up to 12! We have gone from 6 to 22 weeks for shipping goods from China to Europe,” continues Mr Salvetat. As ports becoming increasingly saturated, goods are not being loaded or unloaded fast enough and the circulation of containers is blocked. “This is leading to floating storage, which costs! Today, shippers are paying for goods even though they haven’t yet arrived,” explains Mr Salvetat.

A situation that is giving rise to absurd practices like purchasing empty capacity space from shippers for their return trips to safeguard space for outward journeys – meaning ships are travelling empty in one direction despite huge demand ! – or containers are being abandoned when the storage costs outweigh the value of the goods inside.

The port, witnessing the early signs of regionalisation of trade?

The maritime and port system lies at the heart of globalisation – “we spot crises on the horizon before anyone else,” declares Mr Salvetat. The cost of international logistics chains having soared, inflation is unlikely to come to an end. While at the beginning of the crisis, some (e)-retailers were running their businesses on their stock, now they are practically operating on a just-in-time basis, while the cost of sales, including transport, is higher.

This situation whereby loading capacity is lacking and the cost of freight consequently rising is locked up an oliogopoly. Indeed, nine companies organised into three alliances* represent, by themselves, over 80% of the total capacity of the global container shipping fleet and 95% of capacity on the east-west route.

Pre-crisis, maritime transport was a low margin activity; now it has become more profitable. As Claire Martin, from CMA-CGM explains, “the Group has the possibility of making strategic investments.” Taking the Marseille-based company as just one example, since the crisis, CMA-CGM has taken the opportunity to diversify by expanding its activities along the logistics chain, both up- and downstream.

In reaction to this crisis, the industry is proving quick off the mark. A phenomenon also driven by pressure from civil society over decarbonisation – “we are seeing value chains emerging in zones closer to home,” points out Mr Savetat, especially in the Mediterranean. Mr Boumendil from the UMF shares a similar opinion: “there appear to be early signs of a possible regionalisation of trade, even though China, of course, will remain a major purveyor of consumer goods.” In this context where environmental obligations are gradually tightening and there is desire to consume goods manufactured closer to home, might the economic crisis triggered by the pandemic have accelerated the sharper focus on Europe and the Mediterranean perimeter for producing goods? One thing’s for sure, in this changing landscape, the Port of Marseille is extremely well located!

A consequence for maritime transport, despite the fact growth in container goods traffic was starting, even before the pandemic, to slacken compared to the increase in global GDP (whereas it had, for a long time, grown faster), “one has to question whether the ongoing quest for gigantic container ships will continue,”wonders Léa Loriquet-Ventura from the UMF.

Are European and US consumers going to continue consuming as much as they want from Asia? “Will American antitrust put up for long with this oligopoly and its effects on trade, given that none of these companies are American?” ponders Mr Savetat. Ultimately, might this inflation in transport costs and so the costs of goods made in Asia fast track the move towards regionalisation of production? The think tank Futura-Mobility will continue closely observing these different developments in 2022 and beyond…

*nine companies grouped into three alliances: Alliance 2M (Maersk and MSC), Ocean Alliance (CMA-CGM, Cosco, Evergreen), The Alliance (Hapag-Lloyd, One, Yang Ming Line, Hyundai Merchant Marine). Source: Antoine Frémont from Alphaliner, article ‘Le transport maritime au risque de la démondialisation’, N°445 of the Futuribles review, November-December 2021, p.77

Cover photo ©GPMM