🇩🇰 Towards sustainable horizons for shipping

🇩🇰 Towards sustainable horizons for shipping

Futura-Mobility’s exploratory trip to Copenhagen, in October 2024, was an opportunity for participants to re-explore the world of shipping, whose decarbonisation represents a major challenge for achieving European and international climate objectives.

Every year 100,000 vessels powered by 300 million tonnes of fuel move 11 billion tonnes of goods around the world. This makes shipping accountable for around 1,076 million tonnes of CO₂ emissions annually – around 3% of global greenhouse gas emissions.

Given that global maritime trade is projected to grow 2.4% annually through 2029, pressure has been growing for the sector to take faster action and greater responsibility for the impacts of its activities on the environment. Yet among the barriers to decarbonation are its dependence on high-carbon fuel oil coupled with the long service life of vessels (the average lifetime of a ship is around 25 years).

In 2023, the International Maritime Organization (IMO), the global regulatory body for shipping, adopted a revised (from its 2018 Initial Strategy) plan to reach net zero greenhouse gas (GHG) emissions from the global shipping trade “close to 2050”.

Maersk – decarbonation strategy

Headquartered in Copenhagen, A.P. Moller-Maersk (Maersk), the second largest shipping company in the world (after MSC) has adopted an ambitious decarbonation strategy to reduce its Scope 1, 2 and 3 emissions.*

“Since 2009, sustainability has been a strategy, and progressively since then our work and ambitions have increased with ESG now core to our business,” explains Lene Bjørn Serpa, director, head of Maersk’s Corporate Sustainability & ESG team. “With targets for the short- and long-term, we have 14 ESG categories ranging from sustainable procurement and data ethics to human capital and rights.” In 2018, the Danish group — whose fleet of over 700 vessels transport one in five containers on the sea – was the first shipping company to commit to reaching net-zero greenhouse gas emissions for its ocean activities by 2050. Driven by advances in technology and solutions, this target has since been reset for 2040 and expanded to include its entire value chain, with its investment and action plan to achieve this goal still centred largely around the most material activities on the ocean (operations in terminals represent just 1% of Maersk’s emissions).

To support its net-zero emissions’ strategy and stay at the forefront of energy transition innovations, in 2017 Maersk created Maersk Growth, its venture capital arm whose activities include invests in startups to gain access to emerging green technologies. In addition to financial backing – ticket sizes/amounts invested range from 500 k€ to 5M€ – these start-ups also benefit from opportunities to build partnerships, test their solutions, and potentially to have Maersk as their first client. “Our objective is to add value to Maersk and the start-ups,” say Elizabeth Gunner Schermer, head of Maersk Growth, and investment associate Max Wiest.

Today, Maersk Growth has a portfolio of 40+ start-ups offering solutions to decarbonise the supply chain – electric trucking and fast charging at warehouses, electric parcel delivery in urban areas, circular packaging and recommerce platforms, carbon accounting – and low-carbon fuels – biodiesel, methanol, lignin, and ammonia. Most recently it invested in Swedish sodium-ion battery developer Altris.

Alternative fuels, retrofitting and speed – transition pathways

Focusing on green fuels is key to both cutting Maersk’s emissions and encouraging others to follow suite. Indeed, the Group is committed to the principle of only ordering newbuilt vessels that can sail on green fuels, namely green methanol (e-methanol or bio-methanol). Its first dual-fuel, green methanol container ship launched in 2023. “With this vessel, we have taken an important step in our journey towards net zero emissions,” said Vincent Clerc, CEO of Maersk, during the unveiling ceremony. “Our hope is to show the way – not only for Maersk, but for the entire logistics industry.” Seven large dual-fuel green methanol vessels joined Maersk’ fleet during 2024 and an additional 20 new-builds have been ordered for delivery between 2028-2030.

As well as new-builds, retrofitting existing ships, given their huge cost and 25–30-year average service life, offers another pathway to reducing emissions. Hence the reason Maersk is building strategic partnerships with companies like Hyundai Mipo Dockyard (HMD), a South Korean shipbuilder specialising in the design, construction, and repair of maritime vessels, and the German MAN Energy Solutions, whose activities include retrofitting ships to dual-fuel operation. Most recently, November 2024 marked the completion of a retrofit to dual fuel operation of the container ship Maersk Halifax.

Convinced that shipping will be powered by a mix of fuels in the future, Maersk is following a diversified, fuel-agnostic portfolio strategy. It has adopted green methanol as its initial choice because “it is available today,” explains Ms Bjørn Serpa. “Now the challenge is to make sure we have the supplies.” This explains the company’s investments in green methanol producers both in Europe and worldwide. At the same time, it is keenly interested in other fuels, like ammonia for instance, which is zero carbon. “Yet given the safety and environmental challenges [toxicity, as well as combustible and flammability risks in confined spaces] it poses, a lot more testing is needed,” points out Ms Bjørn Serpa. Another energy avenue being explored is nuclear. In 2024, Maersk joined a joint study from Lloyd’s Register and Core Power to assess the viability of nuclear-powered container shipping.

To reduce energy consumption and hence GHG emissions, a further pathway is reducing vessel speeds (slow steaming). While Maersk sees this as a useful operational measure to both reduce emissions and lower fuel costs (and it’s better for whales too!), this strategy isn’t simple.

One of the challenges is convincing carriers to accept longer transit times, which means organising their supply chains in consequence. Furthermore, geopolitical instability is a concern: the Red Sea crisis, for instance, is currently forcing ships to reroute around the Cape of Good Hope – a longer route that is causing greater fuel consumption and delays.

Maersk – facts & figures*

100,000+ employees

700+ container vessels deployed

65 terminals across 36 countries

130 countries

100,000+ customers

7m+ SQM warehousing capacity worldwide in 450+ sites

2040 Net Zero climate-neutral across its business

*source: maersk.com

Towards zero carbon shipping

Also based in Copenhagen, the Fonden Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping (MMCZCS) founded in 2020, is working to support the transition of the whole maritime value chain towards a zero-emission future. With 60 projects ongoing today, this not-for-profit, independent R&D centre is focusing on three categories of solution: alternative fuels and infrastructure; the market for zero carbon vessels; and regulation.

“Everything we do is published and accessible to all on our website,” explains Kiki Larsen, academia and funding manager, MMMCZCS. “We then use our knowledge to advocate to accelerate the green transition of shipping. Our currency is impact.”

About Fonden Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping

150 staff, 29 nationalities, 50-50 split gender. A platform for collaboration. Non-profit. Tech agnostic. 23 strategic partners provide knowledge, data, and people. Four academic partners: Norwegian University of Science and Technology (NTNU), University of Michigan, World Maritime University (UN), Maritime Research Alliance

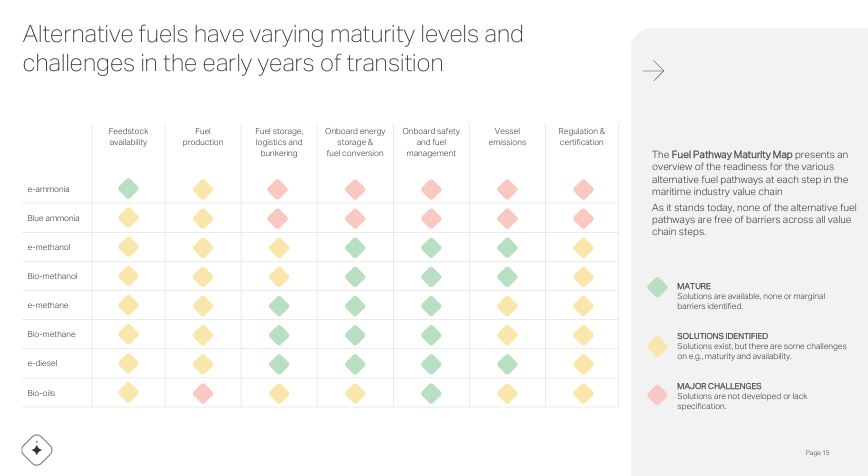

With regards alternative fuels, the MMMCZCS considers e-diesel the most mature today. Ammonia, while promising because carbon-free, poses a safety challenge (toxicity, handling and storage complexities). Green methanol is quite mature, with hybrid vessels now operating. Green biodiesel needs minor tech adjustments but there are issues over availability and price.

The MMMCZCS Fuel Pathway Maturity Map (see below) offers an interactive overview of the current (2024) value chain readiness for the sustainable fuels it expects to be most important in decarbonizing the maritime sector by 2050.

Enabling these new fuel pathways relies on development in all parts of the value chain. “Ports will need to prepare to be able to handle alternative fuels and we provide the methodologies to support that,” points out Serge Dal Farra, shipping decarbonisation project manager at TotalEnergies, seconded to MMMCZCS. “At first place, large ports with experience in handling chemicals are going to be able to handle them because they can manage complexity, not to mention investment.”

In short, new fuels mean new systems, which explains why it is proving hugely expensive for shipping to decarbonise. To help shed light on this issue, the MMMCZCS provides an online Fuel Cost Calculator Tool for calculating the bottom-up production cost of sustainable fuels and benchmarking them against fossil fuels.

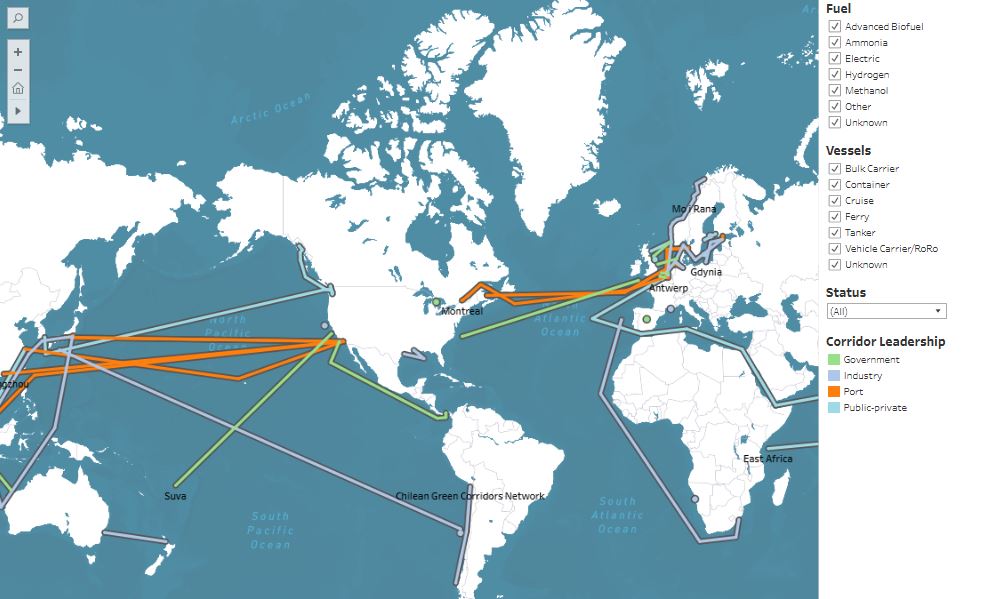

Green corridors and carbon pricing – how to bring clients on board?

Both the MMMCZCS and Maersk fully support the concept of green shipping corridors, launched in 2021 at COP26 : signatory states of the Clydebank Declaration declared their ambition and intent to support the creation of zero-emission shipping routes between ports for 2026. A projects map was subsequently announced in 2023 and developments can be tracked on the Zero-Emission Shipping Mission (ZESM) Green Shipping Corridor Tracker, an interactive map showing green shipping corridor initiatives announced to-date.

Key to these green corridors is collaboration across the full value chain, i.e. ports working with fuel producers, shipping lines working with cargo owners, and so forth. However, the main barriers to uptake by shipowners remain the fuel cost gap and need for coordinated action among stakeholders. Indeed “today, only 2% of cargo is transported on green lines, because customers struggle to pay more,” points out Ms Bjørn Serpa from Maersk. “Right now, alternative fuels are three to four times more expensive. This means we have to ask customers to pay extra for this and many don’t want to. So yes, it’s a big challenge.”

“Shipowners know they’re going to have to decarbonise, so for them green corridors are a field of experience which could give them a competitive advantage in the long term,” suggests Mr Dal Farra. Indeed, in the coming years, failure to decarbonise their vessels could lead to higher costs, regulatory penalties, and a loss of competitiveness as markets increasingly prioritize sustainability.

In the meantime, the question remains: how to shoulder or overcome the extra costs associated with alternative fuels? The cost gap between zero/near-zero GHG emission (ZNZ) fuels (such as green methanol, ammonia and hydrogen) and conventional marine fuels is obviously decentivising the uptake of green energy sources. Hence the reason carbon pricing (placing a fee on emitting greenhouse gases (GHG) and/or offering an incentive for emitting less), is a hot topic right now in the shipping world. All the more so given the IMO’s revised net zero target for around 2050.

Indeed, the industry is on the cusp of being regulated with a mandatory GHG charge at global level under a framework being developed by the IMO. The idea being that this GHG levy will incentivise companies to upgrade their fleets, run them more efficiently and seek cleaner fuels and technologies. “Maersk is doing massive advocacy and reaching out to support the call for carbon pricing,” explains Ms Bjørn Serpa. “In principle, the member states of the IMO can put a price on the use of fossil fuels, as a market-based measure to level the price gap to the green fuels. These discussions are ongoing right now with a final decision expected in 2025.”

Most recently, in January 2025, the International Chamber of Shipping (ICS) joined 47 governments in a joint submission to the final round of negotiations.

All eyes on shipping

What did the Futura-Mobility delegation learn from this visit? Firstly, it is clear the pressure is now on shipping to decarbonise. Three categories of solutions to achieving this goal exist, namely alternative fuels & infrastructure, the zero carbon vessels market, and regulation.

“To reach the IMO’s 2050 target, we need to increase the use of energy efficient solutions, plus a shift to alternative fuels,” says Ms Larsen. “The tech solutions are mature. A lot of things can be done already. The more we can save on energy used, the less we’ll need green fuels.”

Progress towards greater sustainability is ongoing but slow. “Efficient global regulation is needed to level the playing field and incentivise zero carbon shipping by creating certainty among investors and shipowners,” insists Ms Larsen.

“Between 2024 and 2040, the key challenge will be the difference between traditional and alternative fuel prices. We need a level playing field from the regulator,” sums up Ms Bjørn Serpa.

Cover photo : BreakDown on Pixabay

*according to the GHG Protocol, Scope 1: GHG emissions directly from operations owned or controlled by the reporting company. Scope 2: indirect GHG emissions from the generation of purchased or acquired electricity, steam, heating, or cooling consumed by the reporting company. Scope 3: all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.