💡 Energy transition challenges for mobility

💡 Energy transition challenges for mobility

Reconfiguration of energy supply chains, upheaval in dependencies…… the global energy market is shifting, and with this transition come a great many challenges. The mobility sector is feeling the impacts, as well as driving change. During a session on September 26 in Paris, Futura-Mobility welcomed four expert speakers to explore and analyse this evolving energyscape…

“The energy world is in deep crisis,” announces Olivier Appert, member of the French Académie des technologies and advisor to the IFRI (French Institute of International Relations) Energy Centre. “2022 was a dark year with an energy crisis similar on a par with those of 1973/79 for most countries, with regards fluctuations in oil, gas, and electricity prices. The short-term challenges are huge, especially for the European Union [EU].”

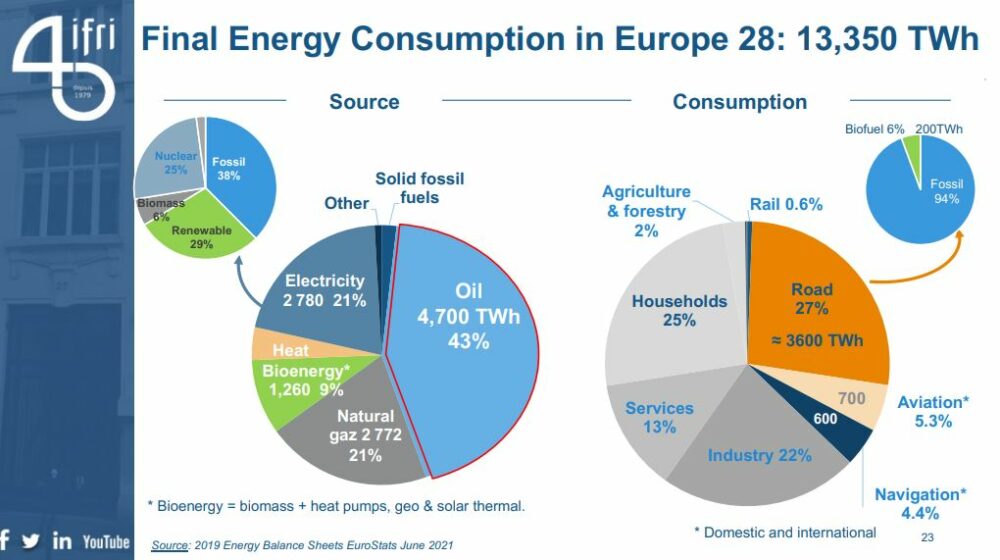

In the EU today, oil represents 43% of all the energy consumed and electricity 21% (see slide below). The key driver of electricity consumption, which was less than 9% in 1971, is electrification in every sector. Indeed, in parallel to the daunting energy crisis, the energy transition is making progress.

To provide an overview and perspectives on the energy crisis, the International Energy Agency’s (IEA) Outlooks on world energy markets and electric vehicles are based on three scenarios, modelled by the World Energy Outlook team: current policies in place; announced measures; and the zero emissions scenario.

“After a golden decade, natural gas is set to face competition from solar PVs and wind energy after the recent supply scarcity and energy security concerns,” explains Oskaras Alsauskas, modeller in the World Energy Outlook team, IEA. “Yet we project LNG demand will grow by around 25% in the next decade.”

“The EU’s dependency on Russian gas has dropped significantly since the invasion of Crimea in 2014, due to a strong reduction in gas consumption of 20% at the end of 2022 compared to 2021,” expands Mr Appert. “At the same time imports of LNG from other suppliers has increased rapidly, due to a 20% decrease in Chinese imports.”

Today the US is a major LNG producer, along with Qatar and Australia. Furthermore, with 45% of European LNG imports set to come from the US, Europe is shifting its gas dependency from Russia to the US.

Farewell to fossil fuels?

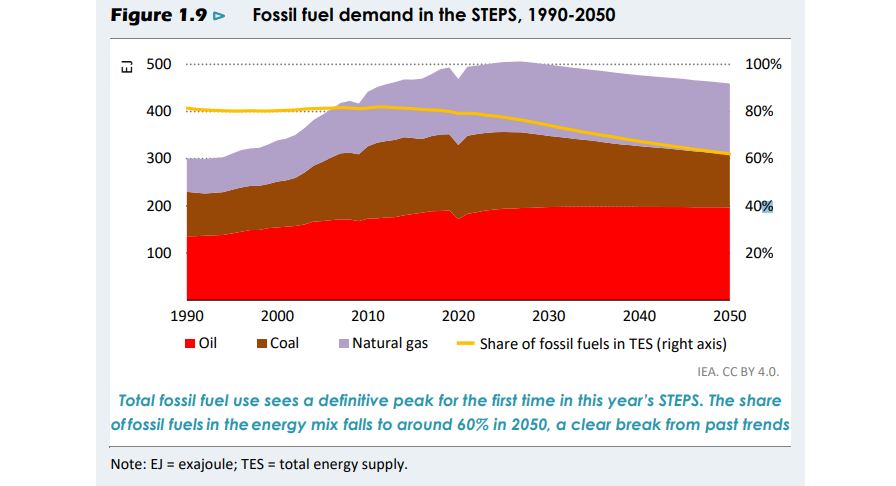

For the first time ever, in 2022 the IEA announced fossil fuel demand is set to peak over the coming decade. “This marks a pivotal moment in energy history and will mean a slow but steady decline in fossil fuels and therefore in emissions,” points out Mr Alsauskas. This peak will be due to natural gas demand plateauing, coal demand peaking in the next couple of years, and oil demand also set to peak by the end of the 2020s. Fossil fuel peak was reassured in the recently published World Energy Outlook 2023.

Nevertheless, given its dramatic increase in oil demand – which has tripled since 2000 and in 2023 represents 50% of world oil demand according to the IEA – China is currently playing a key role in this market. “Given this level of demand, it is really important to know what is happening in Beijing, even more so than in Europe,” insists Mr Appert.

Subject to different uncertainties like economic growth and production policies, the global oil market will likely remain volatile in 2023 with a price range of between 75 and 110 dollars/barrel, possibly with some relaxation henceforth.

Electricity matters

Some interesting trends have emerged in the power grid sector. Electricity is turning the corner. In its scenarios, the IEA projects from 2025 coal demand will start to decline globally in the power industry, combined with a massive growth of renewables – leading to decline in emissions in the power sector. Indeed renewables, namely solar PV, wind, and hydo power are expected to dominate energy capacity additions in the power sector between 2021 and 2050.

Yet since demand for renewables in the power grid will also grow, this will raise the issue of flexibility, on the demand and supply side, i.e., how to maintain electricity security? As coal power plants will be and are being phased out, a flexibility gap will appear.

According to Mr Appert, in the European electricity market in particular, there have been two major wake-up calls that together have created tensions. Firstly, the drop in nuclear production in France (due to the shutdown of plants), which in August 2022 led to the country becoming a net importer of electricity for the first time in four decades. “The French nuclear industry is currently fragile and needs to be relaunched.” And secondly, “due to failure of the market design in Europe, power prices don’t reflect the costs.”

Driving forces behind electromobility

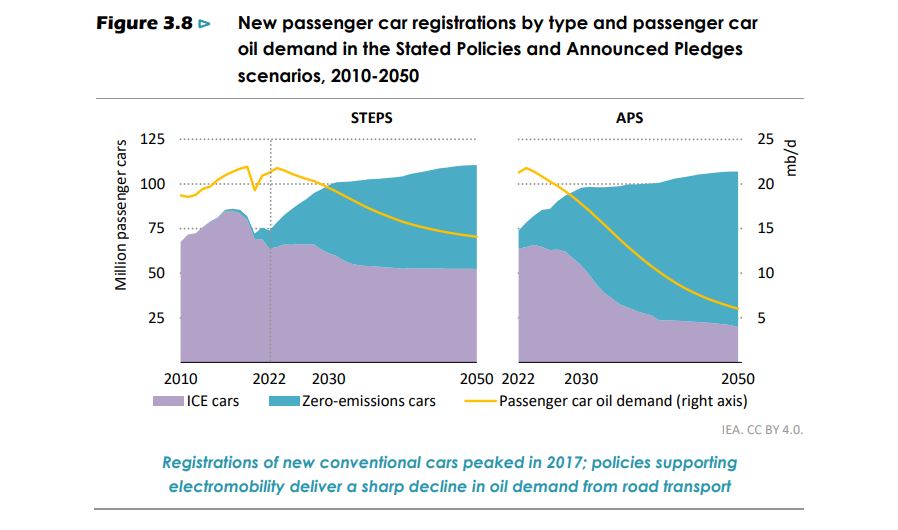

Electromobility is growing everywhere. In 2020, the global market share of electric vehicles (EV) was 4%; by 2022 it had risen to 14% with annual sales of 10 million electric vehicles. This growth of EVs has indeed been especially spectacular in China and the EU, and the US to a lesser extent.

The IEA projects by 2030 across these three key markets, one out of two cars sold will be electric. Yet this huge momentum behind EVs is not being solely driven by environmental concerns. “Of course, these countries are seeing the economic and industrial opportunities and are keen to capitalise on them,” points out Mr Alsauskas, “but there are other factors too. EVs offer energy security benefits by reducing oil demand.”

Recognising the above benefits of EVs, more countries in the 2023 IEA zero emissions report findings (compared to the 2020 edition) are trying to catch up with their targets with real policies being put in place and, effectively, they are reducing their oil demand.

Today, EVs globally are displacing 0.5 million barrels of oil a day and in its scenarios, the IEA projects 5 million barrels a day by 2030, i.e. representing a tremendous reduction in oil demand.

“There is good news coming from battery manufacturers too. A small part of the energy landscape but one we can be happy about,” adds Mr Alsauskas. “Today globally the battery capacity is around 1.5 terrawatt hours but in the light of recent announcements by manufacturers, by 2030, globally capacity amounts should reach 7 terrawatt hours per year, which is slightly more than needed for the IEA scenario to reach net zero emissions by 2050.”

How can aviation meet its environmental commitments?

Under increasing pressure today to decarbonise and meet its environmental commitments, aviation is following three trajectories: drastically reducing fuel consumption of fleets through disruptive technologies; optimising operations (flight paths and on the ground); and substituting fossil fuels with low carbon energy. “And they are all linked. We can’t do one without the others,” points out Nicolas Jeuland, fellow expert / prospective manager ‘Aviation environmental impact assessment and low carbon fuels’, Safran. In this context, it is also important to remember that since low carbon energy aviation is quite a specific industry, some of the technologies already developed for other sectors cannot be applied.

Nevertheless, decarbonation isn’t new to aviation. A typical aircraft today, for instance, emits around 80% less CO2 emissions per passenger/km than in the 1950s, with the same or increased level of safety. “This is already a very good figure,” notes Mr Jeuland. “The improvement is largely down to technology, but also more efficient travel, i.e. higher occupancy of aircraft.”

“To decarbonise aviation, we must tackle the CO2 emissions from long haul flights because they emit the most,” he sums up. “For this category of flights, the only solution is sustainable liquid fuel.”

Technologies, political decisions and incentives – hand in hand

Safran is convinced boosting fleet efficiency through aircraft technology is one key to the energy transition in aviation. Hence the tech being developed like electrification of major aircraft functions and sustainable aviation fuels, as well as weight reduction and increased propulsion efficiency.

A further point to bear in mind, weight and the subsequent fuel consumed is critical in aviation. Even cell phones and laptops make a difference. So any new technologies developed must avoid adding to the weight of aircraft.

Shifting from 60 years of experience with jet fuel to using alternative energies that involve new processes and feedstocks also raises the crucial issue of safety. “The properties of jet fuel are quite unique. It’s the same quality wherever you go in the world,” says Mr Jeuland. “So going forward with new fuels, safety represents a real challenge for the industry.”

The best energy for aviation of the future must be light, safe, and compatible with existing (aircraft have a lifetime of at least 25 years) and future fleets and technologies.

The good news is that a solution already exists – in the form of fuel produced by advanced biofuel technology – that is compatible with 50% of current aircraft technology and airports worldwide without the need for any modifications.

“SAF produced from advanced biomass feedstocks is the only way to decarbonise existing fleets,” explains Mr Jeuland. “Yet here we face difficulties, not only because of the challenges of replicating the same advanced properties of current jet fuel, but also because of uncertainty over future biomass supplies.”

Nevertheless, he believes biomass technology could meet half the fuel needs of aviation by 2050. Yet in order to meet more, decisions must be taken that are out of the hands of the aviation industry, e.g. political decisions over biomass feedstock availability for the sector.

In the twentieth century, the availability of oil led to low prices in aviation… hence the rise of low-cost airlines – even though only 10% of the world’s population have flown once in their lives. Today, the aviation industry is trying to limit future price rises… not lower them!

The aviation industry is currently working on enlarging bio feedstocks and developing new alternative resources, e.g based on low carbon electricity. “We will need electricity, and hydrogen, not only for hydrogen aircraft, but also to produce the biofuels and e-fuels” points out Mr Jeuland.

The future of aviation will likely be fuelled by several types of energy, perhaps with very small aircraft being electrified, bigger regional aircraft being hydrogen, and longer haul aircraft with SAF.

“The pathway to decarbonising aviation is feasible but won’t be easy,” sums up Mr Jeuland. “We are working on the technologies, but they won’t be enough on their own. Some of the other key elements – development of low carbon energy, competition over usage, biomass availability, investments in production units, how to launch a market for sustainable aviation fuel when it costs 4 or 5 times more than jet fuel? – are mostly out of our hands.

“Political questions clearly need answers: do we want to foster the SAF market? Dedicate it to aviation vs other uses? So steps like political incentives, through obligations like in Europe, for instance, will be key to development.”

In addition, it should be noted that during the C20th oil enabled low prices in aviation (low-cost airlines). Yet just 10% of the world’s population has already taken a flight once. However, in the future, they are working to limit price increases rather than reduce them.

‘Critical’ times ahead

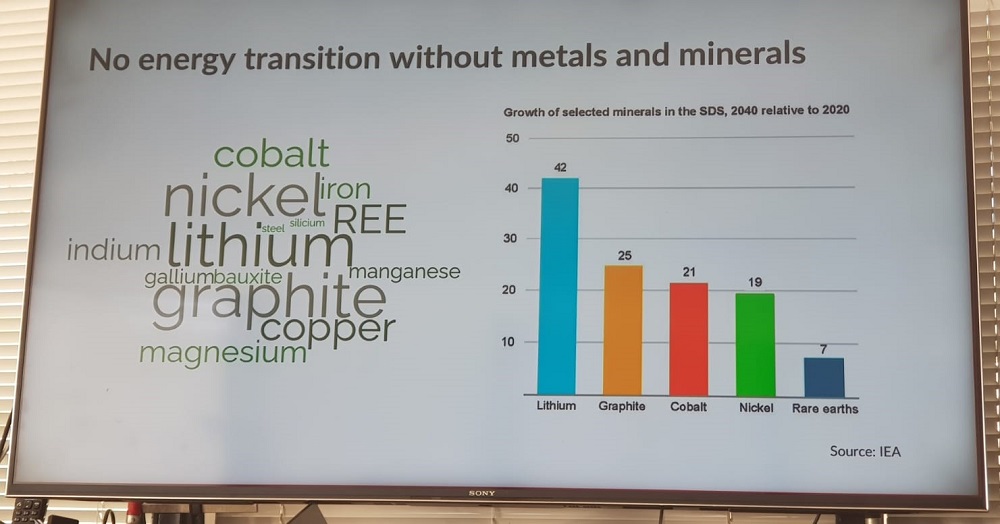

The energy transition depends in large on ‘cleaner’ energy technologies, which in turn consume large quantities of minerals and metals. Consequently, the IEA projects demand for critical minerals will have to increase by X6 from today’s levels of demand by 2050 in the net zero emissions scenario. And specifically with regards metals used for EVs and battery storage, this demand will increase by over X50.

Hence the question marks over supply and possible scarcity of supply of these materials crucial to the energy transition. “End users, EV drivers, won’t feel the immediate effect of a scarcity of these critical minerals, but a prolonged scarcity of supply in this market would still result in higher prices and so delay the energy transition,” explains Mr Alsauskas. “This would cause affordability concerns for the overall energy transition.”

Today, supplies of minerals and metals are coming from outside Europe. They are concentrated in a small number of countries, which China dominates in the fields of extracting and refining. The geopolitical implications of this dependence on critical metals are obvious. Hence the growing concerns in the EU. Particularly since demand is greater than current production capacity and set to grow massively in the years to come.

“There’s a good reason why some of these metals are labelled ‘critical’,” clarifies Guillaume Pitron, French journalist, filmmaker, and author of The Rare Metals War (updated issue published in Sept 2023) and The Dark Cloud (2023). “It’s because the EU and US consider they run the risk of supply shortages; not because of geological reasons but commercial and geopolitical reasons.”

The IEA also sees huge concentrations in the supply chains for critical minerals. When it comes to cobalt and lithium, for instance, the top three producers globally account for over 75% of the total global output. A similar situation is observed in the critical mineral processing and material production parts of the chain. This huge consolidation runs risks on a geopolitical level, as well as physical disruption in the supply chain and possible trade disputes, “all of which could lead to severe consequences within the market for critical minerals,” warns Mr Alsauskas.

Manufacturing EVs requires copper, cobalt, lithium, nickel, and a great many other metals. Over their lifetime, they consume less oil but six times more metals than combustion engine vehicles – “on the one hand, less oil/coal; on the other, more resources from mining,” sums up Mr Pitron.

Given this looming crisis over resources vital for this third energy transition, the European Commission is all too aware history may repeat itself. “Lithium and rare earths will soon be more important than oil and gas,” said Ursula von der Leyen, EC president, in 2022. “Our demand for rare earths alone will increase fivefold by 2030. We must avoid becoming dependent again, as we did with oil and gas.”

To address these fears and accelerate towards more European sovereignty and competitiveness, in March 2023 the EC unveiled its proposed Critical Raw Materials Act. This law aims to ensure no third country provides more than 65% of the EU’s annual consumption of any raw material.

In the meantime, as this global race for mineral independence steps up, Western countries are introducing various ‘hard’ and ‘soft’ regulations, and companies are themselves getting involved in the regulatory context, i.e. gaining greater awareness of what materials they use and the (supply) risks of using them, namely: assessing the degree of exposure, purchasing, and managing the controlling the associated risks.

A darker shade of green

One strategy to tackle the economic and strategic challenges of this growing demand could be to extract closer to home, if, of course, the resources exist. But what about the environmental and societal issues this would entail?

News that a lithium mine might open in France is one example of this darker shade of green that may overshadow Europe in the years to come. Up until now in the EU it’s been a question of out of sight, out of mind (Russia, Kazakhstan, Congo-Kinshasa, Bolivia, China…) when it comes to extracting critical metal resources and their associated environmental downsides.

As Mr Pitron puts it: “a low carbon world is a high resource world. We’re shifting dependencies and issues from the oil fields to mines.”

This is why, although he believes in science and research for a better future, Mr Pitron is also convinced developing a circular economy transition is a must if the energy transition is to be as clean and green as possible. Such an approach would indeed help reduce the consumption of primary materials by, for instance, using second-life primary materials from recycling and optimising processes throughout the life cycle of products. Yet looking further ahead, since demand is rising very quickly, even if all the metals are recycled by 2050, this circular economy would still only represent a maximum of 50% of the materials needed by then.

Winners and losers

While developed countries will continue to drive the global energy transition, it’s a different story for the current energy crisis: “European countries are the big losers in this crisis, which will have significant impacts on our industries and economy and continue for the coming few years,” sums up Mr Appert. “The US is clearly the big winner, and Russia will have difficulties compensating its European outlets over the longer term.”

Limiting the impacts in the EU calls for an urgent redesign of the current energy market to boost renewables and industrial competitiveness, and better protect consumers too. Yet while the EC appears to be taking steps in this direction, any reforms are unlikely to happen in the near future. “I don’t anticipate change in the design of the energy market before the end of the decade”, reckons Olivier Appert, who believes this delay will be in part due to the reshuffling of the political leadership of the European Commission in 2024.

Another major uncertainty is how China plans to play its energy cards. The country is hugely and crucially dependent on coal. It is central to the critical metals market. It is proposing to achieve carbon neutrality in 2060, compared to 2050 in Europe and the US. “So what will happen in China is important to bear in mind!” warns Mr Appert.

Yet there may be some light at the end of the tunnel. While higher energy prices are to be expected in the EU for the coming five years, from around 2026, thanks to investments in new LNG production capacities, coming mainly from the US and Qatar, energy prices may well drop.